Lloyds

Radical was entrusted by Lloyds Bank with the task to explore the option to set up a new innovation capability, that operated like a FinTech start-up, without any of the normal governance and technical constraints most enterprises face.

Using Lean Start-Up techniques to validate assumptions, collaborating with open data groups across the UK, and adopting agile product development techniques to quickly iterate new standalone digital products that could generate tangible business value.

Radical worked with Lloyds to identify the various opportunities and challenges and how digital could improve the business’ goals and objectives. In parallel Radical worked with key Lloyds stakeholders to understand the unmet needs and goals of the customer and employee. This analysis formed the basis of prioritising a set of digital initiatives and defining the vision of a new digital product suite.

Working Capital Management Tool / WCM Tool

One of Radical’s many challenges was to shorten the process of research and analysis conducted by Relationship Managers at Lloyds by bringing it together in one click, helping them serve their clients in an efficient manner.

The previous manual process of reviewing information and offering customised solutions to those businesses was time-consuming. Radical’s approach to solving this problem was to design and develop the WCM tool. The tool provides Relationship Managers with publicly available information about companies across the UK in just one click! Based on the publicly available data found, the tool then generates a data-rich report for a company.

The WCM tool allows the Relationship Managers to gather and analyse information in significantly less time enhancing efficiency and enriching the service and advice they can provide to customers. The comprehensive report reflects various statistics of the company’s performance in the past powered by Debtor days, Creditor days, Stock Days, and Cash Conversion Cycle. The Scenario Analysis offers the functionality to predict various sets of scenarios to understand how the company’s performance impacts their working capital and easily identify opportunities for each.

The Benchmarking functionality reflects the company’s competitors in one view, allowing the relationship managers to get a better understanding of the company’s performance in the industry. The manual and time-intensive process of research and analysis by Relationship Managers was remarkably shortened by the WCM tool, thereby heightening productivity. The data-rich reports empowered them with information to build, maintain and retain a positive relationship with their clients by offering various attractive opportunities.

Radical designed and developed a prototype in just 6 weeks. With positive feedback in the testing phase, the final tool was developed and launched within 16 weeks. Following the final delivery, Radical provides constant support and maintenance to Lloyds to improve the WCM tool and provide immediate development expertise for anything arising on the tool to ensure that the tool remains operable at all times.

Cash Optimiser / Savings Strategy Tool

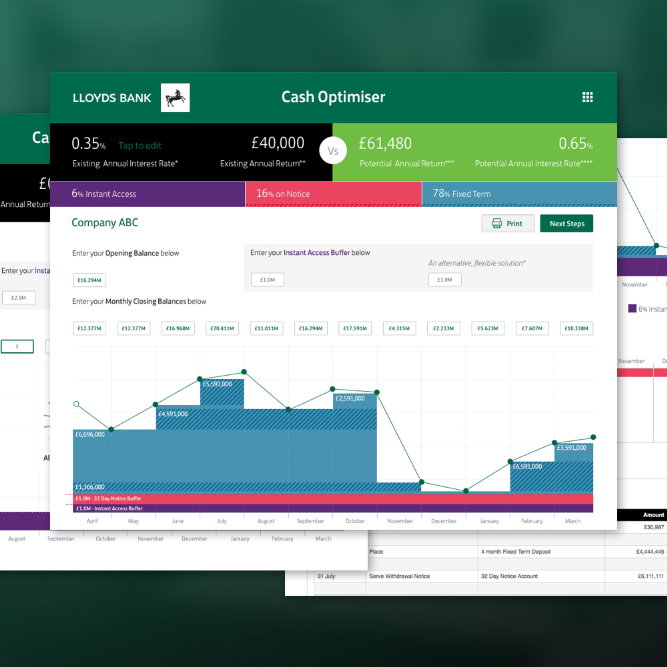

Radical designed and developed the Savings Strategy Tool for Lloyds to offer both existing and potential customers a tool to drive business finance efficiency and plan a deposit strategy. The tool heightened Lloyds’ offerings for their business customers by providing them with the means to understand which Lloyds product suits their needs and help create a bespoke savings strategy. Lloyds Relationship Managers were also empowered by this tool to better manage their client relationships.

The Savings Strategy tool is designed to serve both small-scale businesses and large enterprises to plot a savings strategy with Lloyds to enhance the profitability of their revenue. The tool serves users with a form to be populated depending on their annual turnover and other specific needs. Based on the current financial information entered by the users, the tool generates a bespoke savings strategy along with their existing savings and indicative savings with Lloyds Bank.

Each strategy is customised to a customer’s specific needs by allowing users to compare their current interest rate on savings against Lloyds’ offerings in various timeframes. Whereas, the functionality to add Instant Buffer Access ensures that the tool considers the business’s emergency financial needs while creating a savings strategy. Radical has created a one-of-a-kind tool that brought a new level of innovation to Lloyds bank’s digital products.

The Savings Strategy tool assists users in making a savings strategy decision by providing a one-view comparison of their existing savings and indicative increased savings with Lloyds. This leading-edge tool designed and developed by Radical also serves as a customer acquisition tool for Relationship Managers ensuring constant high-quality lead generation for Lloyds. The action plan functionality provides customers with a deposit strategy with various Lloyds deposit products, an easy option to apply, a downloadable report, and a reference number to discuss the strategy with Lloyds experts. Radical’s solution offered to serve the customer acquisition and retention purposes of Lloyds and help businesses maximise their savings.

In total Radical has launched 8 new digital products for Lloyds, which have had a huge impact on customers and internal business productivity. All the projects identified various cost savings for Lloyds by automating previously manual-led processes. Radical provides ongoing support and maintenance of the products created for Lloyds and continues a strong relationship with the Commercial Bank as an Innovation Partner.